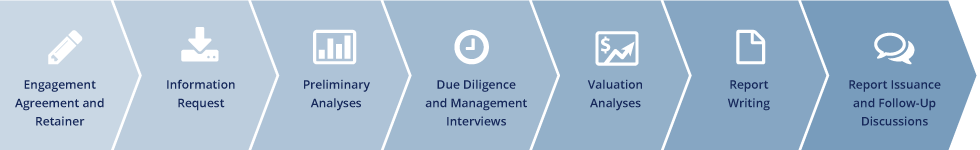

Potential clients often ask about the valuation process and what an engagement typically looks like – particularly if they have never been involved in this type of activity before. We provide here a general overview of the CVG valuation process.

Engagement Agreement and Retainer

The relationship between our client and CVG is typically set out in a written agreement. The agreement defines the scope of the valuation project, the obligations of each party, the estimated time frame, the fee, and other important elements of the relationship. CVG typically requires a retainer at commencement of the work in order to reserve the appropriate staff time and provide evidence of the client’s commitment to moving forward with the project.

The relationship between our client and CVG is typically set out in a written agreement. The agreement defines the scope of the valuation project, the obligations of each party, the estimated time frame, the fee, and other important elements of the relationship. CVG typically requires a retainer at commencement of the work in order to reserve the appropriate staff time and provide evidence of the client’s commitment to moving forward with the project.

Information Request

The next step in the CVG process is information gathering. We provide the client with a detailed list of the requested data and documents needed to properly perform our analysis. Such information may include historical financial statements, current budgets and long-term forecasts, management bios, data on owner compensation, brief descriptions of the history of the business, its products and services, its customer base and the competitive landscape.

The next step in the CVG process is information gathering. We provide the client with a detailed list of the requested data and documents needed to properly perform our analysis. Such information may include historical financial statements, current budgets and long-term forecasts, management bios, data on owner compensation, brief descriptions of the history of the business, its products and services, its customer base and the competitive landscape.

Preliminary Analyses

Upon receiving the required documentation, the CVG team will review it, organize it and perform initial analyses in order to prepare for interviews with the owner and/or key members of management. CVG also begins conducting independent research of the business’ industry, economic drivers, and other issues at this stage of the appraisal process. The primary objective of this step is to help CVG formulate relevant questions for the management interview.

Upon receiving the required documentation, the CVG team will review it, organize it and perform initial analyses in order to prepare for interviews with the owner and/or key members of management. CVG also begins conducting independent research of the business’ industry, economic drivers, and other issues at this stage of the appraisal process. The primary objective of this step is to help CVG formulate relevant questions for the management interview.

Due Diligence and Management Interviews

This step in the process is critically important and assists the CVG team with developing a thorough understanding of the Company – where it’s come from, where it is today and what is expected for the future. Here we begin to understand the story “behind the numbers.” CVG will typically ask questions about the business itself, its industry, organizational structure, marketing activities, customers, technologies and key risk factors. A significant portion of this discussion will also involve the company’s historical financial performance and future prospects. These interviews can be conducted face-to-face or over the telephone – depending on location and schedules, and the preference of our clients. Our access to key management is always subject to the client’s approval and the level of confidentiality surrounding the engagement. A site visit may be helpful, but is not always a requirement. To the extent the engagement includes the valuation of real estate or equipment, a site visit becomes much more important and necessary. Whenever reasonable, however, a site visit does allow CVG to make certain qualitative judgments about the business. Further, in a “high-scrutiny” situation such as an appraisal for a tax-related issue or litigation, the credibility that comes with a site visit cannot be ignored.

This step in the process is critically important and assists the CVG team with developing a thorough understanding of the Company – where it’s come from, where it is today and what is expected for the future. Here we begin to understand the story “behind the numbers.” CVG will typically ask questions about the business itself, its industry, organizational structure, marketing activities, customers, technologies and key risk factors. A significant portion of this discussion will also involve the company’s historical financial performance and future prospects. These interviews can be conducted face-to-face or over the telephone – depending on location and schedules, and the preference of our clients. Our access to key management is always subject to the client’s approval and the level of confidentiality surrounding the engagement. A site visit may be helpful, but is not always a requirement. To the extent the engagement includes the valuation of real estate or equipment, a site visit becomes much more important and necessary. Whenever reasonable, however, a site visit does allow CVG to make certain qualitative judgments about the business. Further, in a “high-scrutiny” situation such as an appraisal for a tax-related issue or litigation, the credibility that comes with a site visit cannot be ignored.

Valuation Analyses

With deeper understanding of the business through our due diligence process, CVG then synthesizes the data, documentation, results of the interviews and independent research to determine how these factors impact the company. At this point, CVG makes a determination as to the most appropriate valuation methodologies to be used in the engagement. Typically, more than one approach is utilized and the results of these approaches will likely provide differing indications of value. CVG uses its professional judgment to then reconcile the approaches into a final conclusion and opinion of value.

With deeper understanding of the business through our due diligence process, CVG then synthesizes the data, documentation, results of the interviews and independent research to determine how these factors impact the company. At this point, CVG makes a determination as to the most appropriate valuation methodologies to be used in the engagement. Typically, more than one approach is utilized and the results of these approaches will likely provide differing indications of value. CVG uses its professional judgment to then reconcile the approaches into a final conclusion and opinion of value.

Report Writing

The type of report required by the client will be determined at the beginning of the engagement. Typically, a detailed report is required to document the complexities of the analysis undertaken to arrive at an opinion of value. The report will cover items such the nature and history of the company, the macroeconomic and industry outlook for the business, the company’s financial condition and earnings capacity, the existence of intangible assets and goodwill, a discussion of any previous sales of interests in the business, and detailed discussions regarding the methodologies employed and the underlying assumptions within those analyses.

The type of report required by the client will be determined at the beginning of the engagement. Typically, a detailed report is required to document the complexities of the analysis undertaken to arrive at an opinion of value. The report will cover items such the nature and history of the company, the macroeconomic and industry outlook for the business, the company’s financial condition and earnings capacity, the existence of intangible assets and goodwill, a discussion of any previous sales of interests in the business, and detailed discussions regarding the methodologies employed and the underlying assumptions within those analyses.

Depending on the client’s needs, there are exceptions when a detailed report is not required for the client’s purposes, and a summary report or a verbal report may be delivered to the client.

Report Issuance and Follow-up Discussions

The final stage of a CVG engagement is delivery of the report. Often but not always, the report will be delivered in “draft” form, allowing the client and their professional advisors to review the facts and assumptions outlined in the report. Other times, a final, signed report may be issued with no draft. Issuance of the report typically includes a follow-up discussion with the client and their advisors to address any questions they may have about the appraisal report.

The final stage of a CVG engagement is delivery of the report. Often but not always, the report will be delivered in “draft” form, allowing the client and their professional advisors to review the facts and assumptions outlined in the report. Other times, a final, signed report may be issued with no draft. Issuance of the report typically includes a follow-up discussion with the client and their advisors to address any questions they may have about the appraisal report.